Download W-2, W-2C Software for Windows to import, print, and manage tax forms. 3 months free with 1-year plan. Download Now Best for customer support $39.99 for the first 12 months. Tips You Need to Know on W 2 Form 2018. The W-2 form is typically sent out by mail from the employers. You can order it straight from the IRS to get your W-2 online. Here are some tips you need to know on your W-2 Form 2018: 1. Your W-2 form shows you how much you have owed in the whole past year and how much you have paid in taxes on those wages. Installer Download - Tax-Print 2020 This is the full working version of Tax-Print 2020 1099 and W2 software that is capable of print 1099-Misc, 1099-NEC and W2 forms to Pre-printed forms such as the free forms issued from the IRS, purchased singe sheet 1099-Misc and W2 forms, or plain paper forms. File Name - Tax-PrintInstaller.exe Version - 20.1.

IRS Form W-2, Wage and Tax Statement. This form is used by U.S. Employers to report annual wages and taxes paid to employees to the IRS. Employees attach this form to their Form 1040 Tax Return.

Free W2 And 1099 Preparation Software

Start pre-filing your Form 2290 today for extra time to pay your HVUT!

Pre-File Form 2290 Now!You'll get your Schedule 1 on July 1,2021!

The Deadline to E-File Form 1099-MISC is March 31, 2021.

E-File Now

E-File in minutes and get instant notifications on your filing status.

Lowest Price ($3.99/form)

We are now Accepting Q1 Form 941 for 2021. E-File Now

Select the form you need and e-file with the IRS/SSA

Form 941 - Employer's Quarterly Federal

Tax Return

Employers file Form 941 every quarter to report withholdings from employee paychecks for federal income taxes, Social Security, and Medicare (FICA).

Get quick processing and instant notifications on IRS approval when you e-file Form 941. It only takes a few minutes.

Form 2290 - Heavy Vehicle Use Tax Return

Truck owners have to file Form 2290 for all heavy vehicles that weigh 55,000 pounds or more and operate on public highways. This form determines your heavy vehicle use tax (HVUT) for the year. When you file Form 2290, you’ll receive your Schedule 1 (proof of HVUT payment). The DMV requires 2290 Schedule 1 for tags and vehicle registration.

E-file Form 2290 and get your IRS-stamped

Schedule 1 in minutes.

Form 1099 - NEC - Nonemployee compensation

Form 1099-NEC is filed to report payments ($600 or more) made to or nonemployees for the work done. Earlier, nonemployee compensation was reported in Box 7 of Form 1099-MISC. Now, the IRS wants it to be reported in a separate form.

E-File Form 1099-NEC in minutes and get the filing status instantly from the IRS.

Form 1099 MISC - Miscellaneous Income

Form 1099-MISC is a yearly tax form that reports miscellaneous payments made to non-employees and independent contractors. These payments include rental payments, fishing boat proceeds, prizes, rewards, or substitute payments in lieu

of dividends.

E-File Form 1099-MISC in minutes and get the filing status instantly from the IRS.

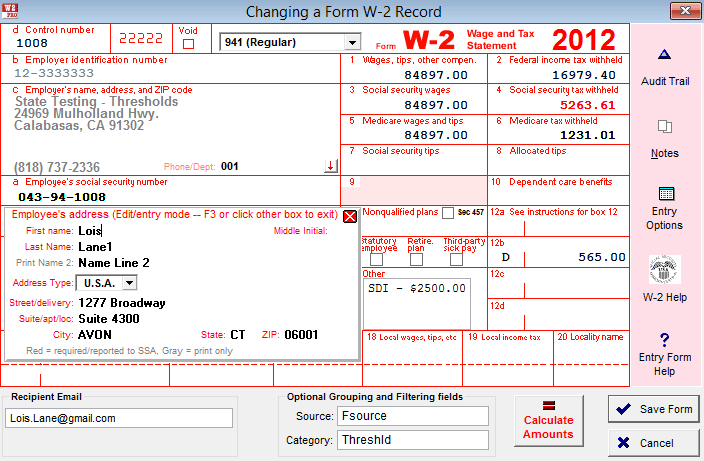

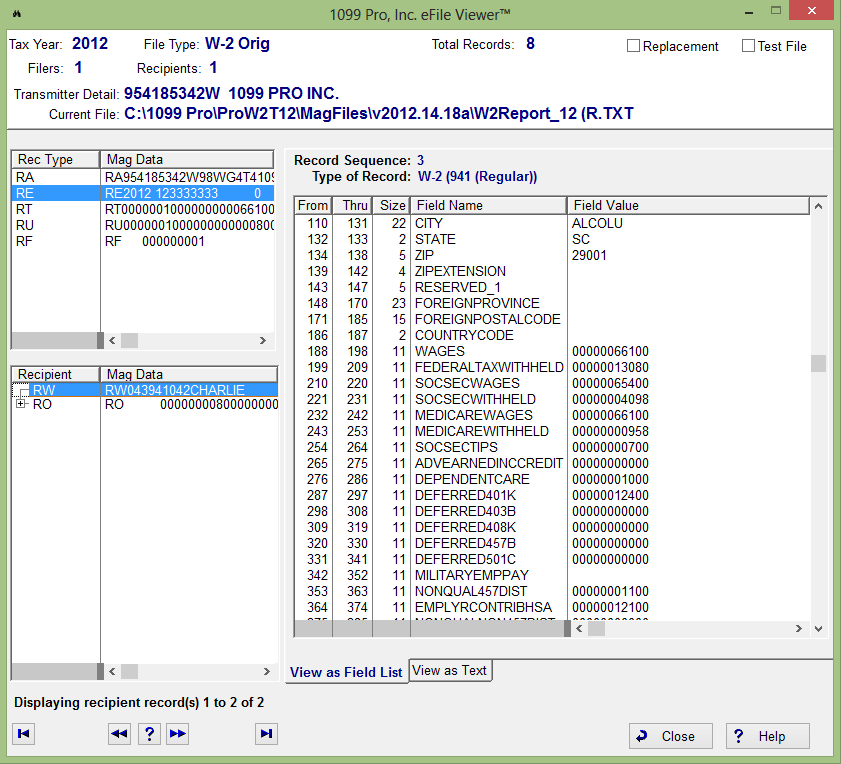

Form W-2 - Wage and Tax Statement

Free W2 Software Download

Employers file Form W-2 every year to report employee wages and the amounts withheld from employee paychecks for Social Security, Medicare, and Additional Medicare taxes. Employers submit Form W-2 to the Social Security Administration (SSA) and send copies to their employees.

E-File Form W-2 in minutes and get the filing status instantly from the SSA.

Form 940 - Employer’s Annual Federal

Unemployment (FUTA)

Tax Return

IRS Form 940 is the federal unemployment tax annual report. Employers must report and pay unemployment taxes to the IRS for their employees.

Free W2 Software 2018 Printable

Get quick processing and instant notifications on IRS approval when you e-file Form 940. It only takes a few minutes.

Form 941-X - Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

Form 941-X can be used to make corrections to Form 941. If you have figured out the errors on your previously filed Form 941, you should use Form 941-X to correct those errors.

You have to file Form 941-X with the Underreported taxes and Over Reported taxes.

Why Choose ExpressEfile?

Free W2 Software 2020

ExpressEfile’s parent company, SPAN Enterprises, is a trusted, IRS-authorized e-file provider. Our software gives small business owners a quick, easy, hands-on filing experience for the lowest price in the industry. With 10 years of experience behind us, ExpressEfile works closely with the IRS and ensures that your information is safe and secure.

E-file Forms 941, 2290, 1099-NEC, 1099-MISC, W-2, 940 with ExpressEfile

Free W2 Software Downloads

Choose your form | Fill in details | E-file directly with the IRS |